Examine Healthcare Payments

Improve the payment experience with insights from the 2021 U.S. Bank Healthcare Payments Insight Survey Report.

U.S. Bank surveyed over 1,000 U.S. healthcare consumers to discover how patients want to pay, what they're concerned about, and how new innovations are transforming payments for the future.

How COVID-19 continues to transform healthcare payments

The pandemic is bringing about profound changes in the healthcare industry, for patients and providers alike. Based on a 2021 U.S. Bank survey of healthcare consumers, the biggest change we’re seeing is accelerated patient demand for digitization.

Top 3 ways digital payments can transform the patient experience

When patients have a better experience with their healthcare providers everyone benefits. Patients are more likely to seek care and find the right treatment, while providers can deliver services more efficiently and collect payments more consistently.

3 benefits of integrated payments in healthcare

Today, healthcare organizations are complex enterprises that rely on a variety of software applications to collect, organize and process information. While these technologies offer many advantages that make managing a clinic or hospital easier, problems and inefficiencies can arise if they work in isolation.

Healthcare Payments Insights

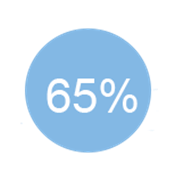

of patients used

telehealth in 2020

69% of these consumers want telehealth expanded

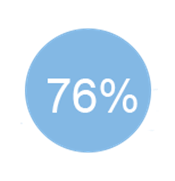

of patients worry about

payment device cleanliness

58% of providers offered their patients touchless check-ins

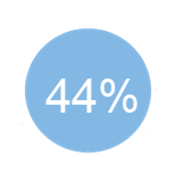

made a payment at provider’s

office on day of service

56% are comfortable resolving payment questions via live text or video chat

3 healthcare payment trends that will continue to matter in 2022

As our 2021 Healthcare Payment Insights Report revealed, the patient experience is going digital. Digitization certainly isn’t new but the need to digitize has greatly accelerated over the last couple of years. Here’s our take on a few key trends that will sustain the drive to digitization in 2022.

Get the 2021 U.S. Bank Healthcare Payments Insight Survey Report

Take an up-close look at healthcare payment systems today with this unique survey of over 1,000 U.S. healthcare consumers.

The report examines:

- How patients want to pay.

- What they are concerned about.

- How new innovations are transforming payments for the future.